AI Reading for Sunday April 6

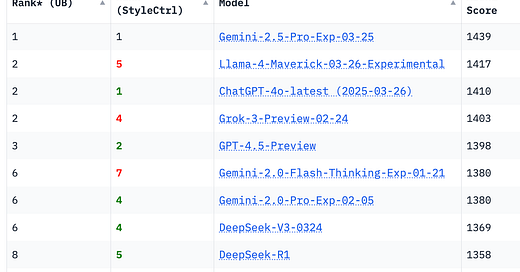

Llama claims top open-source honors in LM Arena, challenges current closed-source leader Gemini 2.5 Pro - The Verge

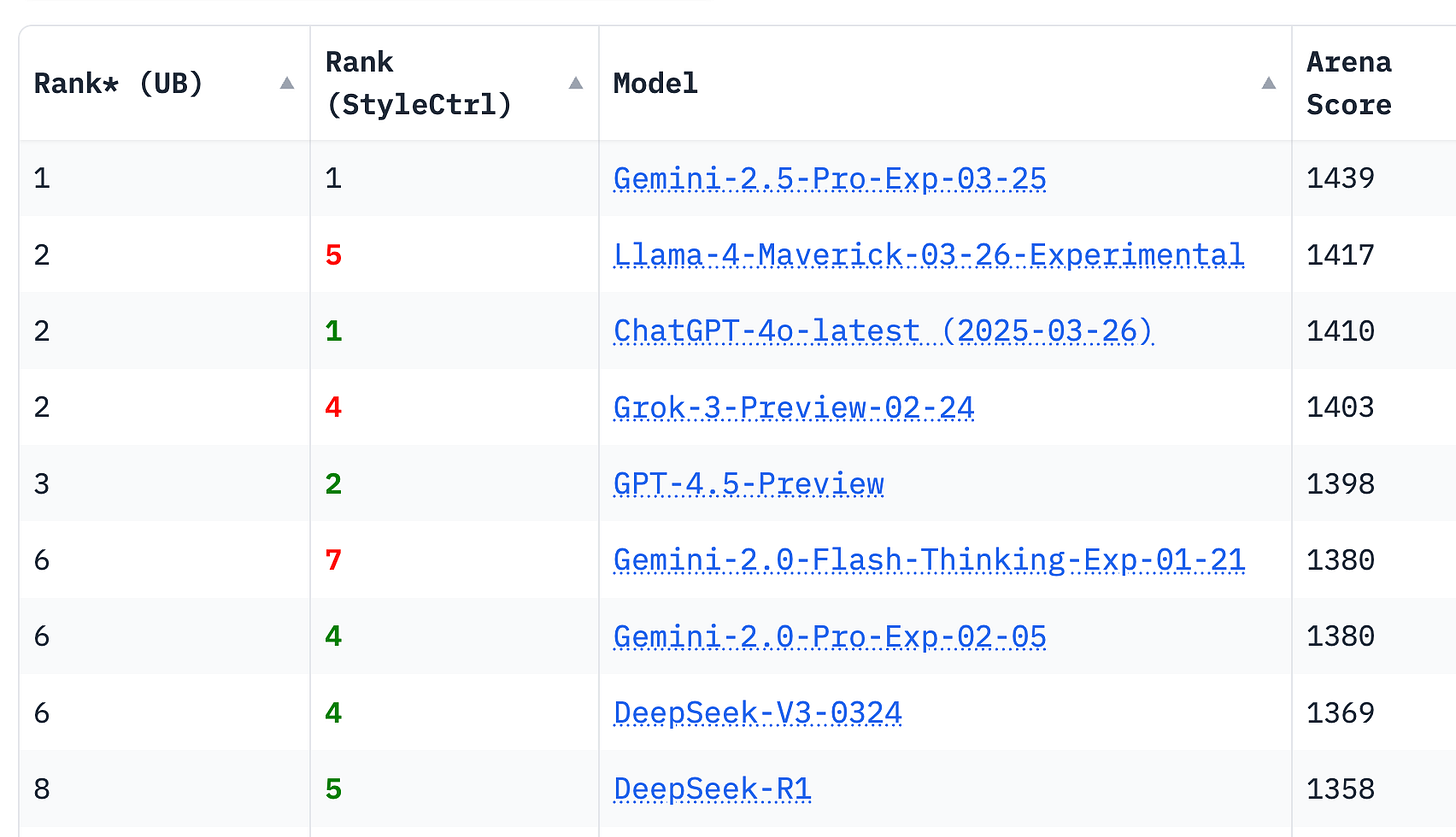

Llama 4 models announced - Meta AI

“Losing lots of money servicing that demand”: AI CEO reveals how companies are losing money on trends like Studio Ghibli style. - Soapcentral.com

Picking up some subscribers who might get hooked on eg deep research, advanced voice mode etc. Also generating some cultural / political pushback.

SandboxAQ raised almost $1b for large quantitative AI models - PYMNTS.com

AI's greatest asset is the human in the loop. - Forbes

ChatGPT Is Now Great At Faking Fraudulent Receipts - Forbes

AI that can check receipts for fake totals, locations…and AI that uses that skill for better fraud will emerge in turn, in spy vs spy dynamic.

Kawasaki's AI robot horse you can ride. Where is my Tauntaun tho? - Xitter

What’s another $100b anyway?

This Meta AI can create talking characters that are good enough for a movie - BGR

Current LLMs are unable to generalize the way humans do. - BGR

AI threatens Wikipedia with huge scraping bills in addition to AI slop content, and users bypassing Wikipedia for AI answers - New Scientist

Inside DOGE’s AI Push at the Department of Veterans Affairs - WIRED

The tariffs are a good case study for doing research with ChatGPT deep research. - ChatGPT

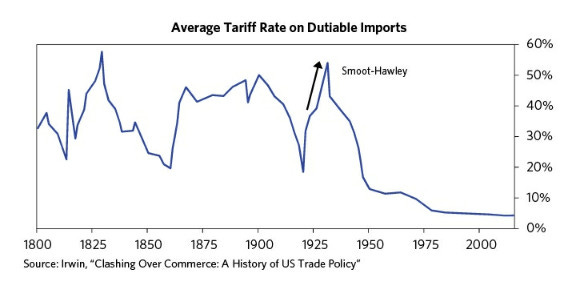

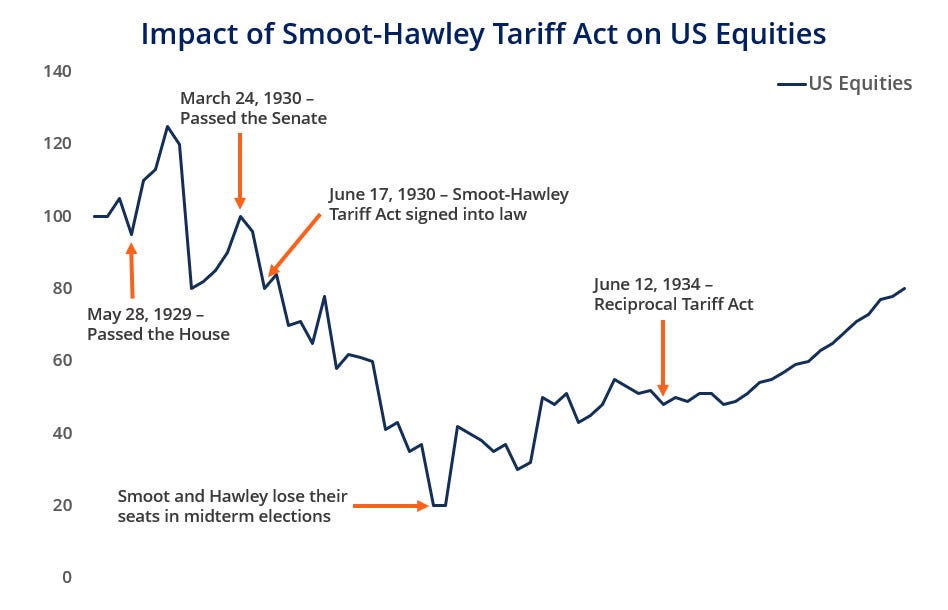

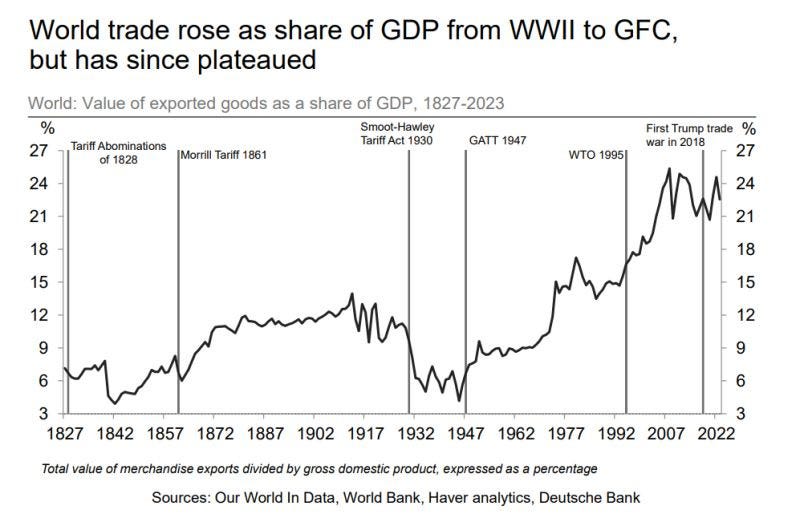

US tariffs are projected to rise by a similar amount compared to the infamous Smoot-Hawley tariffs at the start of the Great Depression.

Let’s see what happened to stock markets then

With the trend toward globalizing supply chains, trade today is running at about twice the level it was relative to GDP prior to the Great Depression.

So, Boeing is importing all this stuff and has contracts to sell planes at agreed prices. Then the price of imports suddenly goes up by 25%. Not good. A ton of transactions already agreed suddenly became un-economical. Now, multiply that by every company in America.

And then there are retaliatory measures taken by US counterparties in response to US policies.

For 30 years, supply chains and markets have been integrating. Throw that into reverse, you add a huge amount of risk to every transaction.

You break everything. You get a ‘sudden stop’.

A ton of manufacturers and retailers will go bust and take banks and real estate with them. There aren’t even decent models for something of this magnitude. >50% tariffs on everything from China, which manufacturers more than the US, Germany and Japan put together? That is a self-inflicted economic Pearl Harbor.

Retribution for imaginary grievances is not ‘reciprocity’. Normalizing criminal insanity will have tragic consequences that no one will escape.

"May God have mercy for my enemies because I won't." - George S. Patton

Good luck everyone.